The 1031 Exchange can be a potent instrument worldwide of real estate investing that permits investors to sell a home and reinvest the profits into a replacement, all although deferring fees around the benefits. The important thing to making the most of your income tax rewards by using a 1031 Exchange is knowing the regulations and rules in the trade and using a certified intermediary. Listed below, we’ll leap in to the information on just how a 1031 Exchange performs and best methods for making the most of this highly effective investment method.

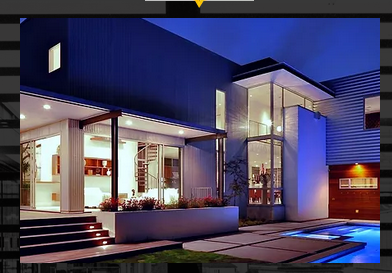

A 1031 Exchange allows investors to defer investment capital profits income taxes by reinvesting the earnings through the sale of any property into a fresh one. To be eligible for a a 1031 Exchange, the qualities engaged must be “like-type,” meaning these are of the same character or character. As an example, an investor cannot swap a institution constructing for the leasing property. Moreover, the use of the home needs to be for purchase or business reasons, not individual use.

To get started on the procedure of a 1031 Exchange, buyers must work with a skilled intermediary, who can support the cash from your sale in the preliminary property until they are utilised to purchase the latest a single. It is essential to choose a qualified intermediary who seems to be experienced in 1031 Swaps and familiar with the rules and regulations governing them. A qualified intermediary can also be liable for managing each of the needed paperwork and ensuring that the swap is performed properly.

Among the key benefits of a 1031 Exchange is it enables investors to defer spending income taxes on the funds gains through the transaction of your property. Rather than paying taxes right away around the profits, the income taxes are deferred until the entrepreneur offers the brand new house acquired with the 1031 Exchange. This gives investors to reinvest a better amount of money into a new house, which can cause increased earnings and likelihood of progress.

There are several methods buyers are able to use to take full advantage of a 1031 Exchange. 1 common method is to purchase a house by using a increased importance compared to 1 being sold within the change. This allows buyers to defer fees over a larger sized volume of money profits, possibly creating better returns as time passes. One more technique is to try using a 1031 Exchange to consolidate a number of attributes into one particular, which could streamline managing and possibly minimize bills.

It is important to note that we now have tough output deadlines associated with 1031 Exchanges. Brokers have 45 days and nights from the date of your purchase in the original property to distinguish possible substitute properties, and 180 days and nights from your sale to complete the exchange. It is essential to make use of a certified intermediary who can assist understand these output deadlines and ensure that all elements of the exchange are carried out properly to increase tax rewards.

Simply speaking

A 1031 Exchange is a highly effective resource for property buyers seeking to take full advantage of their income tax benefits whilst reinvesting in new qualities. By understanding the regulations and rules in the exchange and using a certified intermediary, investors can defer taxes around the benefits from your selling of your property and most likely reinvest a greater amount into a fresh one. Methods like buying a increased value property or consolidating several attributes will also help to make the most of a 1031 Exchange. General, a 1031 Exchange is actually a useful investment approach which can help buyers obtain better results and make wealth as time passes.